Do you feel like your paycheck disappears before you can even blink? Don’t worry, you are not alone! Many people struggle to manage their finances effectively. But what if I tell you that there is a simple and practical strategy to take control of your spending? One of the simplest and most effective methods in personal finance is the 50/30/20 rule of budgeting. It’s a powerful tool that can help you achieve financial stability and reach your long-term goals.

What is the 50/30/20 Rule of Budgeting?

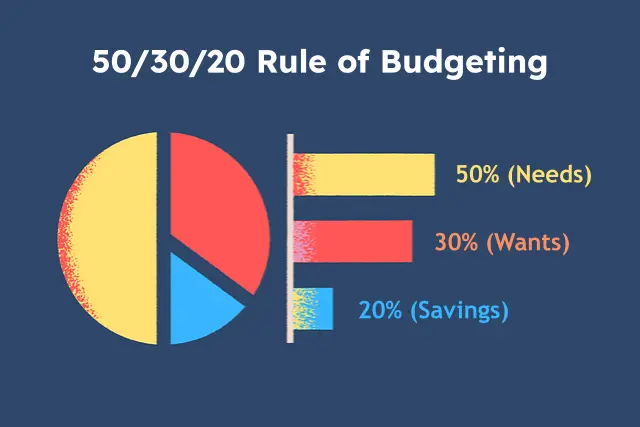

As the name suggests, the 50/30/20 rule is a budgeting technique and a personal finance rule wherein your income is divided into three categories:

- Budget 50% for Needs:

These are essential expenses that you can’t avoid. They include rent or mortgage payments, utilities, groceries, transportation, insurance, and minimum loan payments.

For example, if your monthly income is $3,000, you should allocate $1,500 to cover these necessities. - Budget 30% for Wants:

These are those spendings that enhance your lifestyle but are not essential expenses. They include dining out, entertainment, hobbies, travel, and any other non-essential spending.

Continuing with the same example, $900 of your $3,000 income would go toward personal pleasures such as watching movies, shopping, a dine-out night, etc. - Savings and Debt Repayment (20%):

This crucial portion is dedicated to building your financial future. It includes contributions to savings accounts, emergency funds, retirement accounts, and additional debt payments beyond the minimum.

From our example, you would allocate $600 towards savings and reducing debt.

How to Adjust the 50/30/20 Rule of Budgeting for Different Income Levels?

While the 50-30-20 rule is a great starting point for budgeting and personal finance, it sometimes may not work as it says. Customizing this rule as per your unique financial situation can help you better meet your goals and manage your money more effectively.

Here’s how you adjust and calculate the 50/30/20 rule of budgeting based on your income level:

| Income Level (Monthly Take-Home Pay) | Needs Allocation (%) | Wants Allocation (%) | Savings & Debt Repayment Allocation (%) | Notes |

| Low ($2,000 – $3,000) | 60 | 20 | 20 | Focus on covering essentials and building a small emergency fund. Consider debt consolidation to reduce minimum payments. |

| Middle ($3,000 – $5,000) | 55 | 25 | 20 | More wiggle room for “wants” but prioritize saving for emergencies and retirement. Consider increasing debt repayment if manageable. |

| High ($5,000 – $10,000+) | 50 | 30 | 20 | Increased flexibility for “wants” while maintaining savings goals. Focus on accelerating debt repayment and maximizing retirement contributions. |

Notes: These are just suggestions and can be altered based on your specific circumstances, such as debt obligations, dependents, and housing costs.

Adapting the 50/30/20 Rule for Different Financial Goals

- Saving for a Major Purchase:

If you have a goal of buying a house, you may want to allocate more than 20% of your income towards savings.

Example: If you’re saving for a down payment on a home, you could adjust your budget to 50% needs, 20% wants, and 30% savings. - Paying Off Debt

If you want to repay your debts early, you may be required to reallocate your funds from wants or even needs if possible.

Example: If you have significant debt, you may budget 50% for needs, 10% for wants, and 40% for savings and debt repayment until your debt is under control. - Unexpected Expenses

Life is very unpredictable such as there can arise medical emergencies or job loss. In such scenarios, it becomes crucial to temporarily adjust your budget to handle these challenges.

Example: If you face unexpected medical bills, you may need to reallocate from wants and savings to cover these expenses until things stabilize. - Windfalls and Bonuses

Receiving a windfall (maybe by winning a lottery) or bonus offers a great opportunity to boost savings or pay your debt faster.

Example: In such a case, you may allocate 50% of the bonus to savings, 30% to debt repayment, and 20% for a personal treat.

Common Challenges and Solutions When Using the 50/30/20 Rule

Here are some common challenges people face when using the 50-30-20 rule and solutions to keep you on track:

Challenge 1: Accurately Estimating Income and Expenses

Solution: Track your income and expenses for at least a month. Using a budgeting app, Google spreadsheet or Excel, or even pen and paper is fine. This will give you a realistic picture of your financial landscape.

Challenge 2: Sticking to the Allocations

Solution: Be realistic about your “wants” allocation. Unexpected expenses can happen. Build a buffer within your “needs” category or create a separate “sinking fund” category for occasional larger purchases.

Review your budget regularly (weekly or monthly) and adjust as needed. Do not be afraid to make changes to the allocations as per your circumstances.

Challenge 3: Debt Payments Consume a Large Portion of Your Income

Solution: Consider debt consolidation to reduce your minimum payments, freeing up more money for savings and “wants.”

Prioritize paying off high-interest debt first, as this will save you money in the long run.

Challenge 4: Low Income Makes Needs Allocation Tight

Solution: Look for ways to reduce expenses in the “needs” category (e.g., cheaper phone plans, negotiating bills). Explore government assistance programs if applicable.

Focus on building a small emergency fund first to avoid financial setbacks. Even a few hundred dollars can make a big difference.

Challenge 5: High Income Leads to Lifestyle Inflation

Solution: Review your budget regularly to ensure you’re not increasing spending proportionately with your income.

Automate transfers to your savings and retirement accounts. This removes temptation and ensures you’re consistently saving for the future.

Conclusion

The 50/30/20 rule of budgeting is a practical and effective way to manage your finances. It ensures you a balanced approach to spending, saving, and debt repayment. By understanding and applying this rule, you can simplify your financial life, achieve your goals, and enjoy greater financial security. With the right budgeting strategy, you can achieve financial stability and peace of mind.

Frequently Asked Questions about the 50/30/20 rule of budgeting

1) What is budgeting and why is it important?

Answer: Budgeting is the process of creating a plan for how to spend and save your money. It is important because it helps you manage your finances, control spending, achieve financial goals, and avoid debt by ensuring that essential expenses are covered and savings are prioritized.

2) What is the 50/30/20 rule of budgeting?

Answer: The 50/30/20 rule of budgeting is a simple approach helping you to manage your finances. It suggests you to allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Thus helping you in balancing your expenses and savings.

3) Is the 50/30/20 rule right for me?

Answer: The 50/30/20 rule is a great starting point for anyone looking to manage their finances. It’s flexible and can be adjusted based on your income level, financial goals, and your current living situation.

4) How do I calculate my budget using the 50/30/20 rule?

Answer:

- Determine your monthly after-tax income.

- Multiply your income by 50% (0.50) to find your budget for needs.

- Multiply your income by 30% (0.30) to find your budget for wants.

- Multiply your income by 20% (0.20) to find your budget for savings and debt repayment.

5) How do I adjust the 50/30/20 rule for my income?

Answer: The allocation percentages can be customized based on your income. For lower incomes, you might allocate more towards needs (around 60%) and less towards wants (around 20%). Higher incomes can have more flexibility in the wants category while maintaining savings goals (20%).

6) I have a lot of debt. How can I use the 50/30/20 rule?

Answer: If debt repayment is a priority, you can increase the savings & debt repayment allocation beyond 20%. Consider debt consolidation to potentially reduce minimum payments and free up more money for savings.

7) What if I’m struggling to stick to the budget?

Answer: Be realistic about your “wants” allocation and track your expenses regularly. Don’t be afraid to adjust the percentages as needed. Building a buffer within the “needs” category or a separate “sinking fund” for occasional purchases can also help.

8) How can I handle unexpected expenses?

Answer:

- Build an Emergency Fund: Allocate a portion of your savings to create an emergency fund that can cover 3-6 months’ worth of living expenses.

- Adjust Temporarily: Reduce discretionary spending and, if necessary, dip into your savings to cover unexpected costs.

- Plan for Irregular Expenses: Anticipate and budget for irregular but predictable expenses, such as annual insurance premiums or car maintenance.

9) What if I have irregular income?

Answer:

- Average Your Income: Calculate your average monthly income over the past 6-12 months and use this amount to create your budget.

- Prioritize Expenses: Focus on covering needs first, and adjust spending on wants and savings based on your actual income each month.

- Build a Buffer: Save any excess income during higher-earning months to create a buffer for lower-earning months.

10) Can the 50/30/20 rule help me save for retirement?

Answer: Absolutely! Allocating 20% of your income towards savings and debt repayment includes contributions to retirement savings. By consistently saving a portion of your income, you can build a substantial retirement fund over time.